Looking to buy a home?

From Preapproval to finding a Perfect home, US Mortgage is always ready to help you!

VA LOANS - HOME LOANS FOR VETERANS

VA Home Loan Programs for those who have served and are currently serving our Country

US Mortgage Corporation Proprietary Products

When you are in a rush and time is not on your side, our accelerated 12 business days closing is the solution. Learn more about our RUSH12 Mortgage Product.

Commitment to closing your loan on time, Every time!

With our in-house Operations and our cutting edge technology we are able to guarantee your Mortgage will close on time.

Get Pre-Approved. Shop with Confidence for a Home. Make Offer. Buy Your Home. Let Sellers know that you have already secured solid financing and can close on-time.

How to Apply for VA loans?

- 1

Provide a Certificate Of Eligibility (COE)

- 2

Get Pre-approved.

- 3

Find the house with VA Loan.

- 4

Choose the right loan option.

- 5

Make an Offer

- 6

VA Appraisal & Underwriting.

- 7

Close your loan

Approved by the Department of Veterans Affairs, VA loans are referred to as non-conforming loans due to minimum credit score requirements!

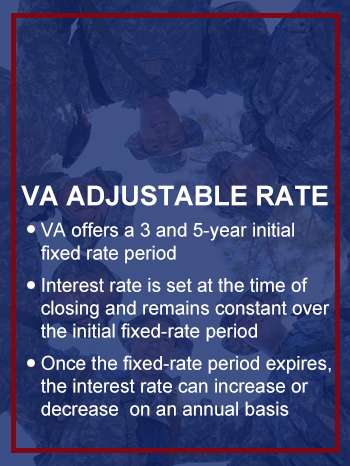

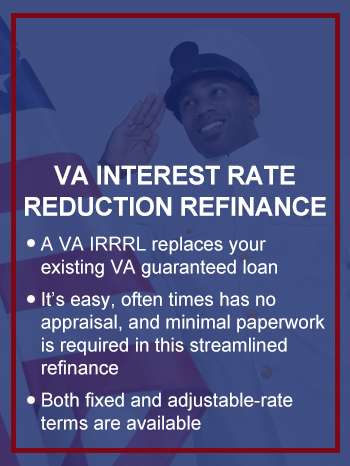

Different types of VA Loans

What are the VA loan eligibility requirements?

The borrower themselves should have served military or can be the surviving spouse. Once you get

preapproved by our loan officers, there are other loan requirements you need to be aware of!

Property Type

VA loans are not applicable for buying a vacation or investment home. You can use VA loans only for buying a primary residence.

Credit score

Usually we prefer a credit score near 600 for approving VA loans. Rest it depends on the different lenders.

DTI( Debt to Income)

It reveals whether or not you are able to pay back the lender the monthly installments or loan.

VA Loan Limit

As per VA guidelines, the loan limit for a VA loan with zero down payment is $548,250 in most US States.

Down Payment

VA department doesn’t ask for any down payments, but your lender can put some T &Cs, or other specific requirements.

VA Funding Fee

It ranges from 2.3 to 6% of your total loan value. It depends on the down payment size, type of service, or if you are a first-time buyer.

Check if you are qualified for the VA loans?

disabilities. You or your spouse must have a record of active servicing in any of the below-mentioned criteria.

- 90 consecutive days during wartime.

- 181 days during peacetime.

- Above 6 years experience with Reserves or as a national Guard.

- Also, the spouse of the deceased militant can’t be remarried.

Buying with a partner? Make sure your co-borrower is also a veteran or is the spouse of the primary borrower.

Benefits of VA loans

Unlike other conventional loans, VA loans are approved with low credit scores, low-interest rates, no insurance,

and lenient loan terms & conditions. The only mortgage loan option that allows you to use 100% of your

home equity in cash-out refinancing. Check various other benefits of VA loans:

Zero Down payment

No need to wait for several years to save the cash. Now you can buy your own house anytime without depositing any cash.

No PMI

Private mortgage insurance is not a requirement to approve VA loans. It saves you a hundred bucks every month.

Up to 4% contribution from Vendors

Sellers can choose to contribute about 4% of home value to save your closing costs.

Refinancing

Already have a mortgage? You can refinance to short terms and lower your interest rates.

Low Mortgage Interests

VA loans are supported by the government so there is almost low risk for both lender and borrower.

Why Choose US Mortgage for VA loans?

Best-in-class loan service.

Additional benefits for Veterans

Title & Loan Services

Competitive Interest rates

FAQs about VA Loans

- Submit a Valid Certificate of Eligibility (COE) or request your lending officer to obtain COE from the department of Veterans Affairs.

- Veteran members need to submit the scanned copy of DD-214 to request the COE.

- Discharged members of the national guard must submit NGB forms 22 & 23 to get COE.

- Discharged members of the selected reserve must submit a copy of the Annual Retirement Points Statement.

- Surviving spouses must submit the death certificate of the spouse, marriage certificate, and applicable VA forms for other benefits.

Basically, a COE is substantial proof of service. A COE indicates whether you are an active military member, spouse of the deceased militant, or a veteran.

Yes of course it’s a great deal for veterans and surviving spouses. The low-interest rates and zero down payment requirements make it way easier to buy your own house.

VA loans are supported and guaranteed by the department of veteran affairs. So, the maximum VA loan limit is $548,250 with no down payment.